Partnerships

Behind every innovation is collaboration . Explore the key partnerships fueling our growth and global expansion.

Biometric Checkout Program

In 2024, PayEye became the first company in Europe to pilot the Mastercard Biometric Checkout Program, introducing an innovative in-store payment experience powered by a fusion of iris and face recognition. Conducted in partnership with Empik, a leading omnichannel retailer, and with technical support from Planet Pay, the pilot allowed customers to pay for purchases using nothing but a glance – through PayEye’s proprietary eyePOS terminals. The program was launched across five selected Empik stores in Poland, supported by a coordinated marketing and PR campaign from Mastercard, PayEye, and Empik.

The results exceeded expectations: 7,758 transactions were recorded, 5,092 PayEye app downloads occurred during the pilot, with a 2,848% increase in downloads in the first month compared to the three previous months. The Net Promoter Score reached 58, and an impressive 90% of users described the biometric payment experience as enjoyable, with 75% of repeat users preferring it over traditional methods. Additionally, 60% said they would switch to this method if available in their favorite stores, and 70% stated that Mastercard’s involvement increased their trust in the technology. The campaign generated 345 media clippings, reached over 3.8 million people, and achieved 204 million total impressions, confirming strong public interest. This collaboration significantly supported PayEye in validating and scaling its technology, collecting regulatory insights, improving user experience, and preparing for a broader commercial rollout of biometric payments.

👉 Read more about our collaboration with Mastercard and discover how we are jointly building the next generation of secure and seamless payment experiences.

PayEye is aligned with Visa’s broader vision for biometric authentication in e‑commerce and digital identity. While our flagship collaboration has been with Mastercard, Visa’s global initiatives, such as the Visa Payment Passkey Service built on FIDO standards – underscore the market direction toward biometric online payments with face or fingerprint verification. This synergy validates the relevance of PayEye’s fusion biometric technology, as Visa advocates for moving beyond passwords and OTPs toward seamless, secure identity-based payment experiences online.

Visa’s publicly shared research confirms the growing consumer appetite for biometric authentication: a global survey found that 74% of consumers view biometric technologies positively, while surveys in Poland show that around 80% of people have used biometrics with nearly universal familiarity among those aged 18–25. Visa also highlights the potential of biometric-based online checkout (e.g. “Click to Pay” and passkeys) to increase merchant approval rates by over 4.5% and reduce checkout friction by up to 40%, factors that strongly align with PayEye’s ambition to deliver fast, safe, and effortless transaction flows

Successful

E-commerce Launch

Empowering Innovation Together

Worldline, a global leader in cashless payment services, and PayEye, a pioneer in biometric payment technologies, entered into a strategic partnership in 2024 to develop and deliver next-generation payment solutions powered by biometrics. Worldline, with over €4.6 billion in annual revenue and daily transaction volumes exceeding 60 million, brings unmatched infrastructure, market reach, and regulatory expertise to this alliance. The partnership marks the beginning of a long-term strategy to implement secure, frictionless, and user-centric payment systems—starting in Europe, with global scalability at its core.

This collaboration reflects a shared commitment to redefining the future of payments, offering businesses and institutions a solution that is not only fast and intuitive but also built on the highest security standards, including full compliance with PSD2, SCA, and PCI requirements. The integration of PayEye’s PCI-certified eyePOS 3 terminals—which combine iris and facial recognition with traditional card, NFC, and QR-based transactions—into Worldline’s ecosystem positions both companies at the forefront of innovation in the physical payment space.

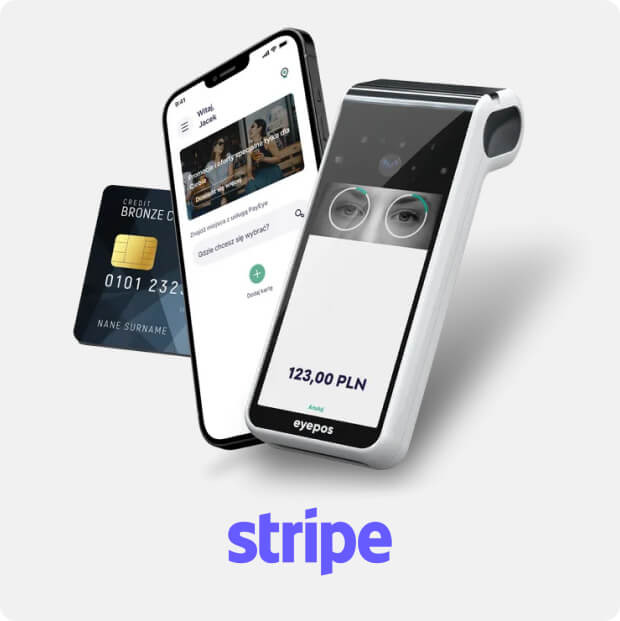

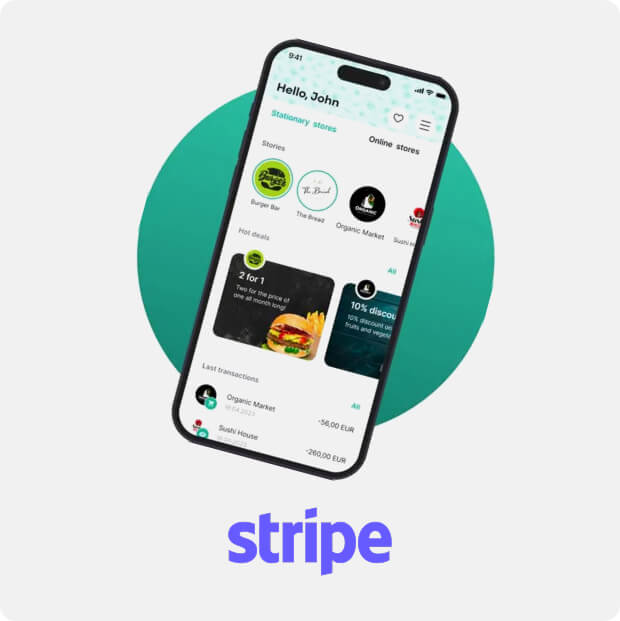

Simultaneously, PayEye made its debut in the U.S. market through a pilot project at Michigan State University, developed in cooperation with Stripe, one of the world’s most advanced digital payment platforms. With Stripe processing over $1 trillion in annual payment volume across more than 100 countries, and growing at over 25% year-over-year, the collaboration gives PayEye a strong launchpad for entering North America’s vast and competitive digital commerce landscape.

Together with Stripe, PayEye is preparing to bring biometric payments to a broad network of U.S. merchants, leveraging Stripe’s scalable infrastructure and real-time cloud processing. As part of this expansion, PayEye is also launching e-PayEye, a revolutionary solution that enables “one-click” biometric payments in online stores—blending security, simplicity, and speed into a single, frictionless customer experience.

Connecting the best solutions